Have you ever wondered how to buy a business with no money? It may seem like an impossible feat, but believe it or not, it is entirely achievable. By leveraging creative strategies and innovative thinking, you can make your dream of owning a business a reality without spending a single cent upfront. In this blog article, we will delve into practical and proven methods that will empower you to take that entrepreneurial leap without breaking the bank. Let’s explore the exciting possibilities together.

How to Buy a Business with No Money

Starting a business from scratch can be a daunting task, requiring substantial capital and resources. However, there is an alternative route that aspiring entrepreneurs can explore – buying an existing business with no money down. While this may seem like a far-fetched idea, it is indeed possible with the right strategy and approach. In this comprehensive guide, we will delve into the various methods and techniques you can employ to purchase a business without having to invest your own capital.

Step 1: Identify the Right Opportunity

Before embarking on the journey of buying a business with no money, it is crucial to identify the right opportunity. Here are some key steps to help you in this process:

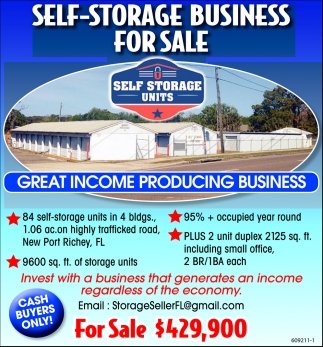

– Research the Market: Conduct thorough market research to identify industries and sectors that are thriving and have potential for growth.

– Identify Distressed Businesses: Look for businesses that are struggling financially and may be open to alternative acquisition methods.

– Networking: Build a strong network within the business community to gain insights into potential opportunities that may not be publicly listed.

– Evaluate Your Skills: Consider businesses that align with your expertise and skills to increase your chances of success.

Step 2: Negotiate a Creative Deal Structure

Once you have identified a promising business to acquire, the next step is to negotiate a deal structure that allows you to acquire the business without using your own funds. Here are some creative financing options to consider:

– Seller Financing: Negotiate a deal with the seller where they provide financing for a portion of the purchase price.

– Equity Investment: Bring on equity partners who are willing to invest in the business in exchange for ownership stakes.

– Earn-Out Arrangement: Structure the deal based on future performance, where payments are contingent on the business meeting certain milestones.

– Asset-Based Lending: Use the assets of the business as collateral to secure financing from lenders.

– Joint Ventures: Collaborate with other businesses or investors to pool resources for the acquisition.

Step 3: Conduct Due Diligence

Before finalizing the acquisition, it is essential to conduct thorough due diligence to assess the viability and potential risks associated with the business. Here are key aspects to consider:

– Financial Review: Scrutinize the financial statements of the business to understand its profitability and cash flow.

– Legal Compliance: Ensure the business is compliant with all legal and regulatory requirements.

– Customer Base: Evaluate the customer base and assess the potential for growth and retention.

– Operational Assessment: Review the operational processes and systems to identify any inefficiencies or areas for improvement.

Step 4: Close the Deal

After completing the due diligence process and finalizing the deal structure, it is time to close the acquisition. Here are the final steps to complete the transaction:

– Legal Documentation: Work with legal professionals to draft and finalize the necessary agreements and contracts.

– Transfer of Ownership: Ensure a smooth transition of ownership by updating all relevant documentation and licenses.

– Integration Planning: Develop a plan for integrating the newly acquired business into your operations and optimizing synergies.

By following these steps and being resourceful and creative in your approach, it is indeed possible to buy a business with no money down. With careful planning and strategic execution, you can turn your dream of business ownership into a reality without having to make a significant financial investment.

How to Buy a Business With No Money in 2024

Frequently Asked Questions

### How can I buy a business with no money down?

To buy a business with no money down, you can consider options such as seller financing, securing a business loan, bringing in a partner with capital, or negotiating a deal that involves equity or profit-sharing.

### What are some strategies for acquiring a business without using personal funds?

Strategies for acquiring a business without personal funds include exploring seller financing arrangements, pursuing joint ventures or partnerships, leveraging assets as collateral for a loan, or structuring a deal based on future business performance.

### Is it possible to acquire a business without any upfront cash payment?

Yes, it is possible to acquire a business without any upfront cash payment by utilizing creative financing options such as seller financing, finding investors or partners willing to provide the initial capital, or structuring a deal based on a combination of equity and future profits.

### How can I negotiate a deal to buy a business without having money to invest?

Negotiating a deal to buy a business without having money to invest involves showcasing your skills, experience, and potential for growing the business to the seller. You can propose creative financing solutions, such as sharing profits or equity, to make the deal attractive to the seller.

### What are some alternative financing options for purchasing a business with no money down?

Alternative financing options for purchasing a business with no money down include securing a Small Business Administration (SBA) loan, exploring peer-to-peer lending platforms, seeking investment from venture capitalists or angel investors, or entering into a lease-to-own agreement with the current owner of the business.

Final Thoughts

In conclusion, Buying a business with no money requires creativity and resourcefulness. Start by targeting distressed businesses willing to negotiate flexible payment terms. Consider leveraging seller financing or securing investors for funding. Additionally, explore alternative acquisition strategies like partnerships or taking over existing debts. Remember, with determination and strategic planning, acquiring a business with no money is possible. How to buy a business with no money might seem daunting, but with the right approach, it can be a viable opportunity for aspiring entrepreneurs.