Looking for a flexible financing option for your business needs? Dell Business Credit might just be the perfect solution. With Dell Business Credit, you can easily purchase the technology your business requires without the strain of large upfront costs. This convenient financing option offers competitive rates and tailored payment plans to suit your budget. Ready to take your business to the next level with Dell Business Credit? Let’s explore the benefits and possibilities together.

Dell Business Credit: A Comprehensive Guide

Introduction to Dell Business Credit

Dell Business Credit is a financial solution offered by Dell Technologies aimed at providing businesses with flexible payment options for purchasing Dell products and services. This credit line allows businesses to acquire the latest technology solutions without having to make a large upfront payment. Let’s delve deeper into the details of Dell Business Credit to understand its benefits and how it can help businesses grow and thrive.

Benefits of Dell Business Credit

1. Flexible Payment Options

With Dell Business Credit, businesses have the flexibility to purchase the technology they need without tying up cash flow. This credit line offers various payment terms and options, allowing businesses to choose a payment plan that suits their financial situation.

2. Access to Dell’s Latest Technology

By utilizing Dell Business Credit, businesses can access Dell’s innovative products and services without having to make a significant upfront investment. This enables businesses to stay up to date with the latest technology trends and remain competitive in their industry.

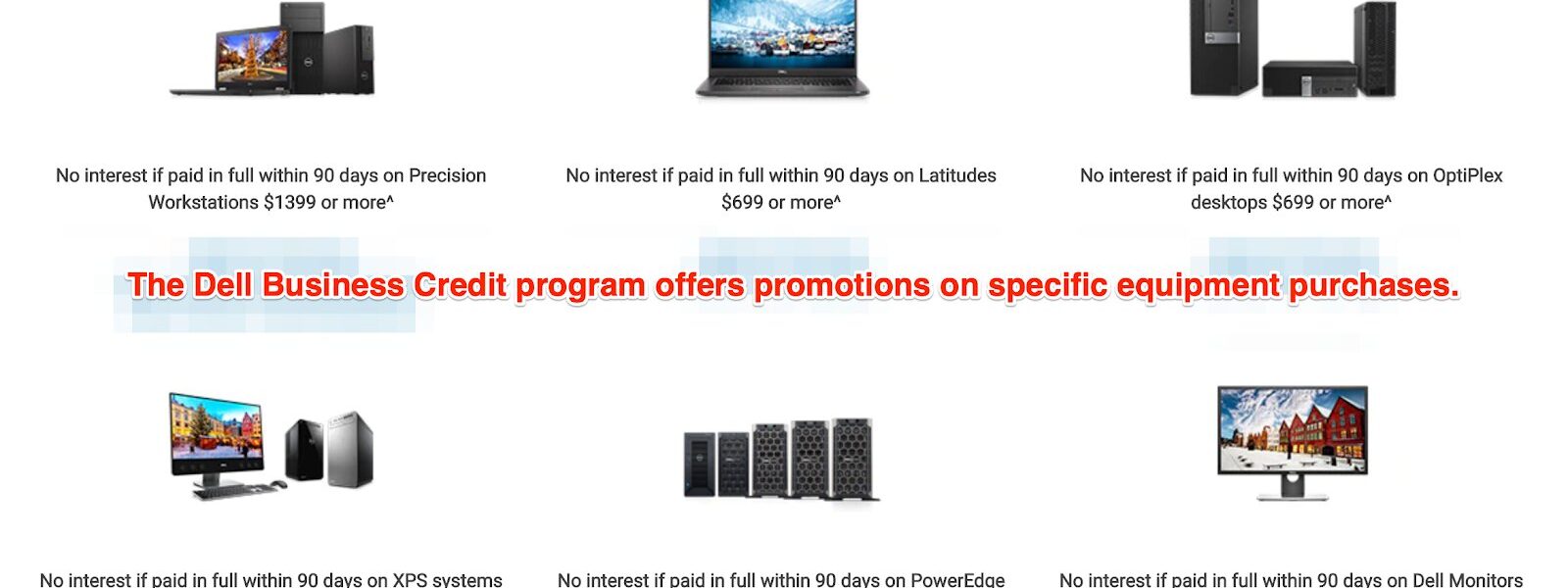

3. Special Financing Offers

Dell often provides special financing offers for businesses using Dell Business Credit, such as promotional financing with 0% interest for a certain period. These offers can help businesses save money on interest and manage their expenses more effectively.

How Dell Business Credit Works

Dell Business Credit works as a revolving line of credit that businesses can use to make purchases from Dell. Here is an overview of how Dell Business Credit operates:

1. Application Process

Businesses interested in Dell Business Credit can apply online through Dell’s website. The application process typically involves providing business information, financial details, and other relevant data for credit assessment.

2. Credit Approval

Once the application is submitted, Dell will review the business’s creditworthiness and financial history to determine the credit limit. Upon approval, businesses will receive their credit limit and can start making purchases using Dell Business Credit.

3. Making Purchases

Businesses can use their Dell Business Credit to buy Dell products, software, services, and accessories. The credit can be utilized for online purchases, phone orders, or through Dell’s sales representatives.

4. Managing Payments

Businesses are required to make regular payments on their Dell Business Credit account based on the terms agreed upon during the application process. It is essential to make timely payments to maintain a positive credit standing and continue using the credit line effectively.

Tips for Maximizing Dell Business Credit

1. Understand Your Payment Terms

Before making any purchases using Dell Business Credit, ensure that you fully understand the payment terms, interest rates, and any promotional offers available. This knowledge will help you make informed decisions and avoid any unnecessary expenses.

2. Utilize Promotional Financing Offers

Take advantage of Dell’s promotional financing offers, such as 0% interest for a specific period, to save on financing costs. Make sure to pay off the balance within the promotional period to avoid accruing interest.

3. Monitor Your Spending

Keep track of your purchases and payments to stay within your credit limit and avoid overspending. Monitoring your spending will help you maintain control over your finances and make strategic purchasing decisions.

In conclusion, Dell Business Credit is a valuable financial tool that can help businesses acquire the technology they need to succeed. By offering flexible payment options, access to the latest technology, and special financing offers, Dell Business Credit empowers businesses to invest in their growth and stay competitive in today’s fast-paced business environment. Embracing Dell Business Credit can be a strategic move for businesses looking to leverage technology to drive their success.

NO PG Business Line of Credit – Dell Business Revolving Line of Credit

Frequently Asked Questions

### What are the eligibility requirements for Dell Business Credit?

To qualify for Dell Business Credit, you must be a business entity, meet Dell’s credit requirements, and be based in the United States. Additionally, Dell may consider factors such as credit history and financial stability when assessing eligibility.

### How can I apply for Dell Business Credit?

You can apply for Dell Business Credit by visiting the Dell website and filling out the online application form. Make sure to provide accurate business information and be prepared to undergo a credit check as part of the application process.

### What are the benefits of using Dell Business Credit for my business purchases?

Dell Business Credit offers various benefits such as flexible financing options, exclusive deals, special financing offers, and access to Dell’s small business advisors. Additionally, using Dell Business Credit can help you manage cash flow and simplify your purchasing process.

### How does the credit approval process work for Dell Business Credit?

Once you submit your application for Dell Business Credit, Dell will review your information and conduct a credit check. The approval process typically takes a few business days, after which you will be notified of the decision.

### How can I manage my Dell Business Credit account?

You can easily manage your Dell Business Credit account online through the Dell website. This portal allows you to view your account balance, make payments, track transactions, and access account statements conveniently.

Final Thoughts

In conclusion, Dell Business Credit offers a convenient financing solution for businesses looking to invest in technology. The flexible payment options and competitive rates make it a valuable tool for managing cash flow and upgrading equipment. By utilizing Dell Business Credit, businesses can access the latest technology without strain on their budgets. Consider Dell Business Credit for your next technology purchase to streamline your procurement process and stay ahead in the competitive market.